FCRA Registration and compliances

FCRA Registration & Compliances for Trusts & NGOs in India

Taxes in India deter many foreign nationals from applying for lawful donations. For such purposes, the Government issues them some incentives, assuring them the donations made will be provided entirely to the intended beneficiary. Most donations are directed towards taxes. To counter such effects of the Taxation system, online FCRA registration becomes necessary.

The FCRA in India regulates foreign money as well as hospitality to various NGOs. Such registration is necessary to get money from foreign institutes. The FCRA primarily regulates foreign donations and ensures that it does not affect the domestic political scene.

Our services include FCRA Registration, Filing of Annual returns, FCRA Audits and Regulatory compliances

FCRA Registration

FCRA Department comes under the Ministry of Home Affairs. FCRA Registration is optional for NGO / Trust / Section 8 Company

In order to regulate the foreign contribution or foreign hospitality received by any individual, association or company the Government has consolidated all the laws and regulations relating to such transactions. For this purpose Foreign Contribution (Regulation) Act, 2010 was enacted. This was done to create a transparent mechanism for individuals and organizations through E-governance of FCRA related activities. This transparent system was created to discourage any detrimental activities which can be against national interest.

Types of FCRA Registration

FCRA Registration can be categorized in two types, one is proper FCRA registration and other is prior permissions. Apart from the eligibility criteria defined for the applicants, period of existence of the applicant organization is also a determining factor for deciding the Category of FCRA registration. Following are the specifications determining the type of FCRA registration.

Proper FCRA Registration

In order to be eligible to apply for proper FCRA registration following minimum requirements must be met with:

- The applicant must be registered and operating for a minimum period of 5 years.

- The organization must have spent minimum 10 Lakh rupees in the last 3 years for furtherance of its main objects. This amount shall not include any kind of administrative expenditure.

- The applicant is also required to submit last 3 years financial statements. These financial statements must be audited by qualified Chartered Accountant.

Prior Permission

On the other hand, if a newly registered organization is willing to receive any kind of foreign contribution then it can apply for prior permission. Following minimum requirements are to be met with in order to apply for prior permission:

- The foreign owner is specified at the time of making application.

- The funding is to be used for specific purpose.

- Amount of foreign contribution is also defined.

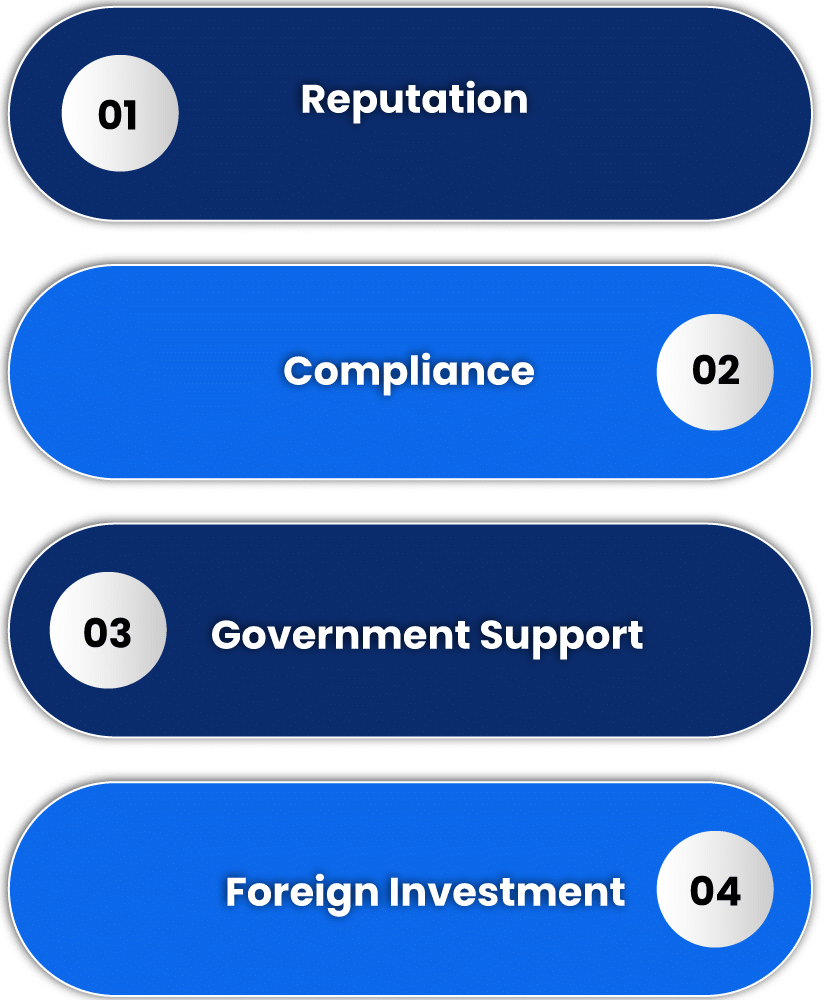

Benefits of FCRA Registration

An entity would secure the following benefits through FCRA registration:

Reputation

Usually this form of registration is carried for societies and NGOs. NGOs relying on foreign funds require registering under the requirements of the FCRA. An entity registered under this system would be reputed in the society.

Compliance

Entities that are registered with the requirement of FCRA would be compliant with relevant regulations.

Government Support

FCRA registration is a government registration which is prescribed by the regulatory authorities. Hence an applicant can utilise full government support through this form of registration.

Foreign Investment

Another benefit of FCRA registration is continuous support and investment from foreign entities. The support may be from the registered foreign head office or from another foreign entity.

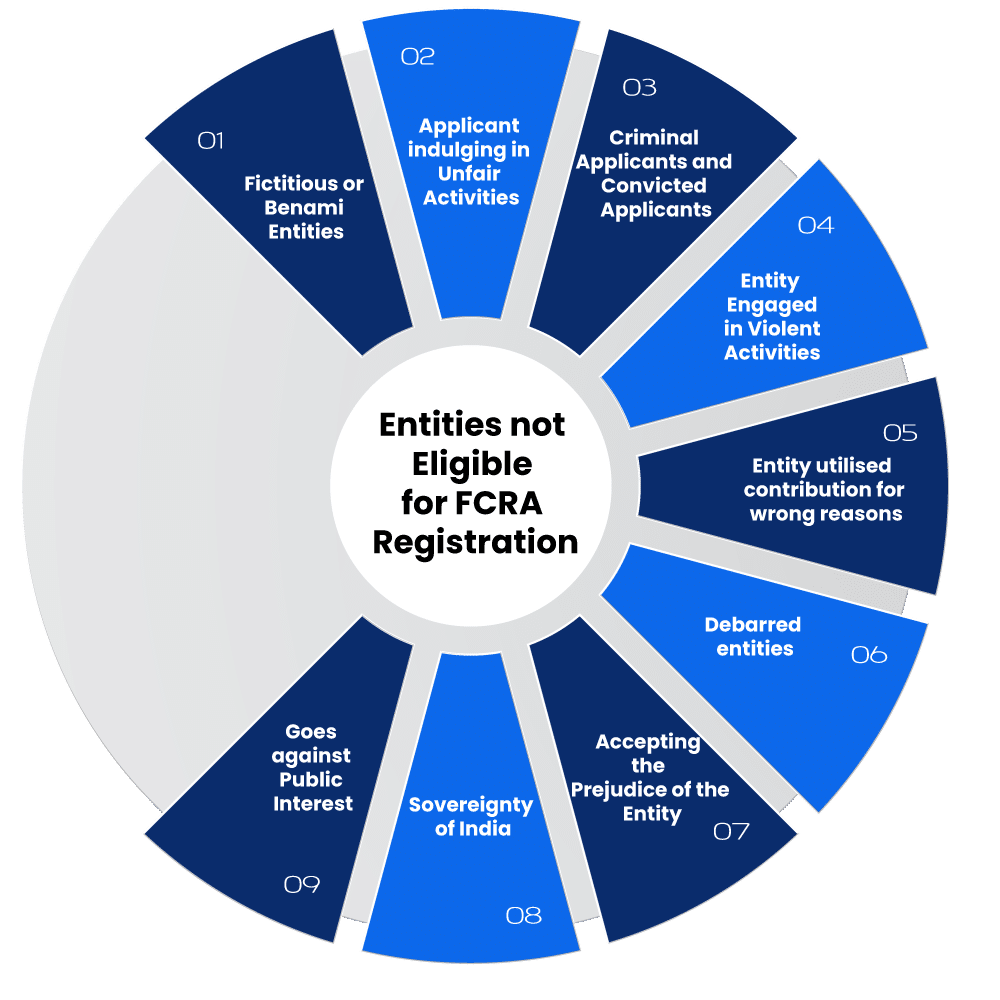

Entities not Eligible for FCRA Registration

The following entities are not eligible for FCRA registration in India:

Fictitious or Benami Entities

Usually such entities which are formed as a result to carry out some form of fraud would not be given any permission related to FCRA registration in India. Some entities do not exist under the provisions of law. Such entities would not be granted FCRA registration.

Applicant indulging in Unfair Activities

Any applicant who has indulged in unfair activities which has resulted in the criminal conviction of the applicant would not be granted FCRA registration or FCRA license. An applicant would not be eligible to consider FCRA registration, even if the applicant is awaiting some form of prosecution under the respective authority.

Criminal Applicants and Convicted Applicants

Any applicant or society which engages in activities which result in conviction or criminal proceedings would not be allowed to go for the process of FCRA registration. An entity which is adjudged bankrupt and insolvent by the competent court would also not be granted FCRA registration.

Entity Engaged in Violent Activities

Any entity which is engaged in violent activities would also not be granted FCRA registration. The meaning of violence would include any activities which cause disruption to the public. This will also include causing any form of unlawful activities related to violence which disrupts the peace of the public.

Entity utilised Contribution for wrong reasons

Any entity which utilises the funds provided by a foreign company for wrong reasons would also not be permitted to go for FCRA registration. If the funds utilised are for personal reasons then registration would not be permitted.

Debarred Entities

Any entities which have been debarred in the past for conducting criminal activities would not be allowed to register as per the requirements of the FCRA.

Accepting the prejudice of the Entity

If the foreign contribution is provided to the entity which affects the prejudice of the entity then such entity would not be allowed to go for FCRA registration.

Sovereignty of India

As per the Constitution of India, any entity that goes against the sovereignty or integrity of India would not be allowed to go for FCRA registration.

Goes against Public Interest

If the funds provided are used against the interest of the Indian public, then the same would not be allowed. FCRA registration is not allowed for the above entities.

Eligibility Criteria for FCRA Registration

As we have discussed for receiving any kind of foreign contribution FCRA Registration is mandatory requirement. Now we will discuss who is eligible to apply for FCRA registration. The applicant must be a non-profit organization registered and operating under any of the following statutes:

- Under Indian Trusts Act, 1882 as registered Trusts or

- Under Societies Registration Act, 1860 as registered Society or

- Under Companies Act, 2013 as a Section 8 Company etc.

Along with the organizational registration following pre-conditions are also required to be satisfied by the applicant to receive foreign contribution:

- The applicant institutions must have been set up with charitable objective of serving the society in any manner like promotion of health, education, art, cultural, religious, sports etc.

- The organization must not have been prohibited as per Section 3 of the Foreign Contribution (Regulation) Act, 2010.

- FCRA Registration is granted after proper assessment of application by the authorities.

Process of FCRA Registration?

The process of FCRA Registration is quite straightforward. This registration is done through filing an online application on Form FC-3. Scanned copies of all the relevant documents and information are required to be uploaded at the time of filling this form.

However, there is a pre-requisite to this registration. To register under FCRA, the NGO must have a DARPAN ID. For this ID, it is required to register on DARPAN portal provided the NITI Aayog.

However, this seems relatively easy. There is a long list of documents required to be attached with the application. Thus, it is recommended to take expert help of professionals in the process. The authority has been very strict in terms of approving the FCRA Registration application. The applications along with the attached documents are analyzed in great detail. In past large no of FCRA Registration / License have been canceled.

Our team of experts can ensure to file error free FCRA Application will reduce the chances of rejection / re-submission.

What is The Document Requirement for FCRA Registration?

For Registration

- Self-certified copy of registration certificate/Trust deed etc., of the applicant association.

- Copy of PAN of the NGO.

- Self-certified copy of relevant pages of MOA/AOA/Deed reflecting the main objects of the association.

- Jpg file of signature of the chief functionary.

- Activity Report of last three years.

- Copies of audited Assets and Liabilities, Receipt and Payment, Income and Expenditure statement etc. of last 3 years reflecting the expenditures.

- Detail about the current and past management of the trust.

- Annual report of the NGO and details of work done in past 3 years.

- A true copy of the resolution passed by the Governing Body of the NGO.

- A Copy of certificate issued by the Income Tax Authority under 80G & 12A of the Income Tax Act.

For Prior Permission

- Self-certified copy of registration certificate/Trust deed etc., of the applicant association.

- Copy of PAN of the NGO.

- Self-certified copy of relevant pages of MOA/AOA/Deed reflecting the main objects of the association.

- Jpg file of signature of the chief functionary.

- Duly signed approval/commitment letter from the foreign contributor.

- Copies of audited Assets and Liabilities, Receipt and Payment, Income and Expenditure statement etc. of last 3 years reflecting the expenditures.

- Detail about the current and past management of the trust.

- A true copy of the resolution passed by the Governing Body of the NGO.

- A Copy of certificate issued by the Income Tax Authority under 80G & 12A of the Income Tax Act.

Return Requirement after FCRA Registration

After Successful FCRA registration, the registered entity is required to file a return annually in prescribed Form FC –4.

After registration, the entity is required to maintain proper accounts and record of all the foreign contribution received as well as its utilization. And file a return in FC-4 online.

Certified (by CA) and Scanned copies of the following documents must be submitted with the return:

- Income and expenditure statement,

- Balance sheet

- Statement of receipt of Foreign contribution and

- Payment made by the entity.

Due Date: FC-4 is required to be filed within 9 months of the closing of every financial year i.e. by 31st December of every year.

Validity of FCRA Registration

FCRA Registration granted by the authorities after due verification of the application is not valid for lifetime. Following is the validity period in both the cases Proper FCRA Registration and Prior Permission:

For FCRA registration under normal course

In this case, the registration is valid for a period of 5 years from the date of approval. After expiry of this period, it is required to be renewed for receiving any further foreign contribution.

For Prior Permission

Following is the validity period of registration under prior approval method:

- 5 years from the date of approval or

- Till the date, the foreign contribution is fully utilized for which the prior permission was granted.

Renewal of FCRA Registration

As specified above FCRA registration has a validity of 5 years, at the end of which it lapses. Thus the non for profit organizations are required to file a renewal application for the same. Following are the timelines for filing renewal application:

- Generally, the registered entity is required to submit a renewal application at least 6 months before the registration lapses.

- However, if the registered entity is working on ongoing multi-year projects then this renewal application is required to be filed at least 12 months before the FCRA registration lapses.

Cancellation of FCRA Registration

Authorities have the right to cancel FCRA Registration if they are of the opinion that the operations of the NGO are not as per the provisions of the law. They have been very vigilant and proactive in this test. In the past 4 years, more than 4000 FCRA registrations have been canceled due to this.

There are many reasons which influence the decision to cancel FCRA Registration. Following are few such reasons;

- The NGO fails to submit required compliances under Foreign Contribution (Regulation) Act, 2010 or any other regulating laws.

- If there is any allegation or complaint made against the organization stating wrongdoings in the operation of the organization. And after enquiry, they are proved to be true.

- The foreign contribution received by the NGO is not utilized for the purpose stated in the FCRA Registration application.

Recent Updates Related to FCRA

In September 2020, the Government of India brought out a major amendment in FCRA registration requirements. This bill which was introduced by the Government was the FCRA amendment bill. Some of the features of this bill are:

- Foreign funds which are provided to the entity has to be utilised by the entity itself.

- Administrative Expenses for foreign contribution is capped at the rate of 20%.

- More transparency introduced between the giver and receiver of funds.

- No public servant can receive any foreign contribution.

- The recipient has to have an Aadhaar card and comply with the requirements.

Frequently Asked Questions about FCRA Registration?

Q1. When is FCRA Registration Required?

Whenever any NGO either in the form of Trust, Society or Section 8 company is willing to receive any kind of foreign contribution or donation, they are required to obtain FCRA Registration under Section 6 (1) of Foreign Contribution (Regulation) Act, 2010. Irrespective of the nature of the contribution i.e. either cash or kind, the registration is mandatory. Enterslice is well known FCRA Consultants in India. We help organization willing to register under FCRA.

Q2. In case of prior approval can Foreign contributor and Indian recipient organization have common members?

Yes, it is possible. But, there are certain pre-conditions to be satisfied. They are:

1. The Chief Functionary of the recipient organization shall not be the Foreign contributor (if contributor is individual) or a part of Foreign contributor organization.

2. Majority (51%)of members of the governing body of the recipient organization are not related in any way either as family or as members/employees of the foreign contributor.

Q3. What is the difference between prohibited and disqualified person?

There is a basic difference between prohibited and disqualified person. The prohibited person does not qualify for FCRA registration just because of its inherent nature. However, on the other hand in case of disqualification the person could have been able to apply for registration if it was restricted because of any act done by them. Such ‘act’ disqualifies them from filing an application.

Q4. What is the difference between Registration and Prior Permission under FCRA?

As we have discussed there are two separate ways to receive foreign contribution, i.e. registration and prior permission. Following are the point of difference is the eligibility criteria.

For registration: It is required that the applicant

1. Is in existence for a minimum period of 3 years.

2. Has done reasonable work in the area to public interest.

3. Has spent at least Rs.10,00,000/- over the span of last 3 years for the furtherance of their main objects.

For Prior Permission: The applicant is not required to be registered for any minimum period as they are in the initial state. No work experience is required. However, the registration is situation specific in nature. This means that the prior permission is for:

1. Receipt of a specific amount of foreign contribution.

2. From a specific contributor.

3. For any specific project/ activity.

The applicant is required to submit a copy of approval letter from the foreign contributor for the stated amount of contribution.

Q5. Who is prohibited to accept foreign contribution?

1. Anyone contesting election.

2. Editor, owner, printer, publisher, columnist, cartoonist or correspondent of any registered newspaper.

3. Judge of court of law, government servant or any employee of a Corporation either owned or controlled by the Government.

4. Member of any legislature.

5. Any political party or its office bearer.

6. Any other organization of political nature specified under sub-section (1) of Section 5 by the Central Government.

7. Any company or association engaged in the production or broadcast of news or current affairs programmers through any electronic mode of mass communication, or any other electronic form as defined in clause (r) of sub-section (i) of Section 2 of the Information Technology Act, 2000 or otherwise.

8. Editor, owner, correspondent, cartoonist or columnist, of any organization referred to in point 7.

9. Anyone else who have been prohibited from receiving foreign contribution.

Q6. Who can be a foreign contributor?

Section 2(1) (j) of FCRA, 2010 has provided clear definition of Foreign source who can provide foreign contribution. This list includes the following:-

1. Any foreign Government including any agency of such Government.

2. Any international agency, this will not include any agency specifically excluded by the Central Government by notification ( like United Nations or any of its specialized agencies, the World Bank, International Monetary Fund etc.).

3. Foreign company incorporated outside India.

4. Any foreign corporation.

5. Any multi-national corporation referred to in Section 2(g) sub-clause (iv) of FCRA, 2010.

6. Company registered under Companies Act, 1956, whose minimum 51% of share capital is held, either singly or in the aggregate, by:

a. Foreign Government.

b. Foreign citizens.

c. corporations incorporated in a foreign country or territory

d. trusts, societies or other associations of individuals (whether incorporated or not), formed or registered in a foreign country or territory

e. Foreign company.

7. Foreign trade union either registered or not.

8. Foreign trust or a foreign foundation financed majorly by a foreign country or territory.

9. Any society, club or other association or individuals formed or registered outside India.

Q7. Under FCRA what constitutes as foreign contribution?

In order to apply for registration, first it is necessary to understand what actually constitutes as foreign contribution. The definition of ‘foreign contribution’ is stated under Section 2 of the Foreign Contribution (Regulation) Act, 2010. It states that “foreign contribution” will include any donation, delivery or transfer made by any foreign source,

1.Of any currency, whether Indian or foreign.

2.Of any article. However, if such article is a gift and its market value at the time of transfer does not exceed Rs. 25,000/-.

3.Of any security as defined in clause (h) of section 2 of the securities Contracts (Regulation) Act, 1956 and includes any foreign security as defined in clause (o) of Section 2 of the Foreign Exchange Management Act, 1999.

Q8. How can a person accept foreign contribution Under FCRA?

As it was above mentioned, for receiving any kind of foreign contribution FCRA registration is mandatory. There are two ways to receive such contribution under the Act, they are:

1. Proper Registration: They are already under business for a minimum period of 3 years.

2. Prior Permission: This route is for organizations in their initial formative stage.

In order to accept foreign contribution following conditions must be satisfied:

1. The receiver must have been involved in cultural, economic, educational, religious or social program me.

2. It must either have FCRA registration or prior permission under the Act.

3. The receiver is not included in the prohibited list under Section 3 of FCRA, 2010

Q9. Who are disqualified to apply for FCRA registrations?

Before making an application for registration we have to be clear that the applicant is not disqualified under the Act. Following are the conditions which disqualify a person:

1. It is fictitious or benami in nature.

2. Either the applicant being an individual or in case of any organization any of its directors/ office bearers has not been prosecuted or convicted for

a. Forcing religious conversions either directly or indirectly through their activities.

b. For creating communal tension.

3. Is involved in propagation of sedition or advocating violence of any nature.

4. Found guilty of wrongful utilization of its funds and is likely to use amount of contribution for its personal gains.

5. Has contravened any of the provisions of this Act.

Q10. Who can be an applicant for FCRA?

One basic pre requisite for registration under FCRA is that the applicant must be a registered under an existing statute including.

1. Societies Registration Act, 1860 or

2. Indian Trusts Act, 1882 or

3. Section 8 of Companies Act, 2013) etc.

Q11. What is validity period of registration under FCRA?

Once the applicant is granted registration under FCRA, such registration shall remain valid for a period of 5 years.

However, in case of Prior Approval the validity expires once the forien contribution is fully utilized, for which the permission was/is granted. This period shall not exceed 5 years.

Q12. What are the restrictions relating to foreign contribution?

Under Section 12 (4) (g) it is clearly stated that no registered person under FCRA can accept any amount of any foreign contribution which:

1. Can lead to incitement of an offence or

2. Can endanger the life or can cause physical harm to any person

Q13. Whether any donation by an individual of Indian origin and having foreign nationality be counted as ‘foreign contribution’?

Yes. Such donation will be treated as foreign contribution. However, ‘Non-resident Indians’, who still have Indian citizenship will not be counted in this category.

Our Services

A range of services adapted to your needs

FCRA Registration

In order to regulate the foreign contribution or foreign hospitality received by any individual, association or company the Government has consolidated all the laws and regulations relating to such transactions.

FEMA Advisory

With an increase in cross-border transactions, both inbound & outbound, there is a heightened need to understand & ensure compliance with complex, evolving legislations covered under the Foreign Exchange Management Act (FEMA) 1999.

Foreign Remittance/15CA/15CB

When it comes to filing taxes, it is not only individuals who need to ensure all the proper procedures are followed and forms submitted.Banks and Financial Institutions have rules that must be followed

GST Registration for Foreigners

Goods and Services Tax or GST has been implemented in India from 1st July, 2017 and non-resident taxpayers are also required to obtain GST registration and file GST returns.

NRI Taxation Filing

Complete assistance in order to make optimum utilisation of tax benefits available to NRIs under Indian domestic tax laws and Double Taxation Avoidance Agreements (DTAAs)

India entry Strategies

India is one of the most ideal destinations for foreign investors looking to set-up their businesses in India. The country not only provides a conducive environment for business but also offers tremendous opportunities for the investors.

Foreign Company registration

To open a Wholly Owned Subsidiary in India (WOS INDIAN SUBSIDIARY) , foreign entity should be registries as an Private limited company Section 2(42) of the Companies Act, 2013

Global Company Incorporation

No. minimum registered capital No Local Partnership required,100% Foreign ownership allowed,Joint venture registration is allowed,Business Feasibility report

OUTSOURCED ACCOUNTING AND TAX

Outsourced accounting services For companies that are in the early stages of growth, accounting and taxation can appear to be complicated and time-consuming problems.

Client We Serve

Automobiles

Public listed corporation engaged in automotive wheels manufacturing in India.Large pan-Indian automotive component manufacturer.

Banks

Fortune 500 multinational European bank.Fortune 500 multinational American bank

Chemical Industry

Leading German chemical multinational.Multiple leading Italian chemicals multinationals

Bilateral Trade Agencies

Leading European bilateral chamber of commerce

Need Help?

Contact our customer support team if you have any further questions. We are heare to help you out